By Newsfangled International Desk

12 June 2025 | Geopolitics, Technology, Trade Wars

In this article

The Setup

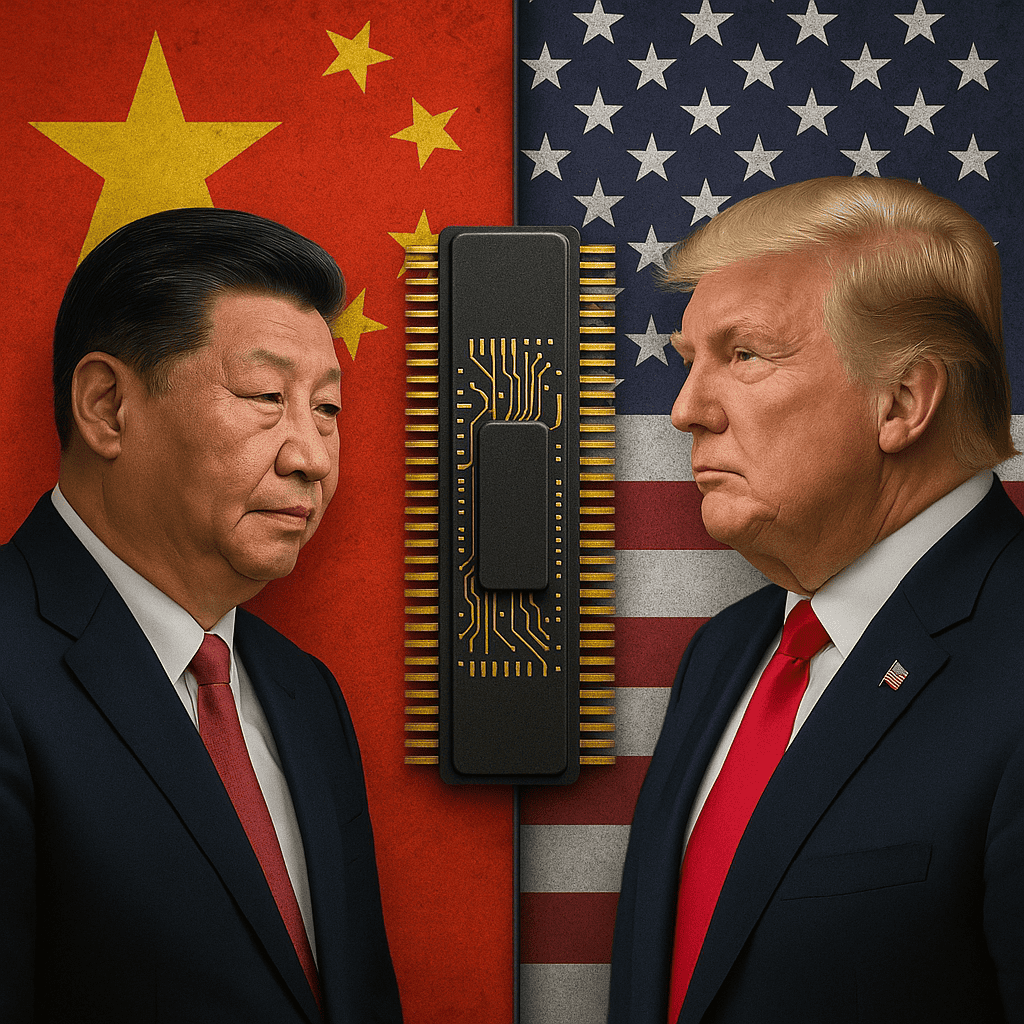

China chip sanctions are spiralling into a full-scale tech Cold War. On Tuesday, independent analyst and economic commentator Sean Foo released a sharp update that cuts to the silicon core of global geopolitics: China has pulled the export trigger. In response to escalating China chip sanctions and tightened U.S. controls on advanced technologies, Beijing is now accelerating its pivot toward domestic tech independence — just as Donald Trump makes it clear he won’t be reversing course on America’s aggressive semiconductor blockade. It’s a stance in line with his broader isolationist approach to tech and trade, as seen in earlier moves like the travel ban fallout.

This isn’t your average policy spat. It’s a full-on strategic standoff, and both sides are playing to win.

Exporting Smarter, Not More

While U.S.-China trade tensions are nothing new, there’s a quiet evolution happening beneath the usual sabre-rattling: Chinese exports to the U.S. are decreasing in volume, but increasing in value. The Yuan’s shift and a boost in high-tech, high-value goods mean Beijing is quietly restructuring its trade profile — less bulk, more brains.

Foo points to data showing that although overall export tonnage is down, revenues are rising due to a sharp focus on electronics, AI components, and green tech products like solar panel infrastructure and EV batteries. This signals not only economic resilience but a strategic redirection away from dependency on Western buyers for low-margin goods. Some observers suggest that this shift may even be a long-game reaction to earlier rounds of China chip sanctions.

Washington Holds the Line

Meanwhile, the Trump camp remains firmly entrenched. Despite private sector pressure and concerns over supply chain fragility, the administration is refusing to reverse its semiconductor sanctions. The rationale? U.S. officials argue that allowing access to cutting-edge chips could enhance Chinese military and AI capabilities — a risk they’re unwilling to take. That echoes growing concerns about dual-use technologies in other hot zones, such as the Ukraine theatre covered in our Kyiv report (https://newsfangled.co.uk/postcards-from-kyiv-graham-fuse).

The Biden administration’s earlier attempts to “contain” China’s chip race through multilateral export controls and diplomatic pressure have now morphed under Trump 2.0 into a far less flexible policy: no deals, no exceptions, no chips. With no sign of Washington easing China chip sanctions, Beijing’s retaliation is unlikely to be short-lived.

Beijing’s Strategic Counterpunch

Faced with this hardening U.S. stance, Beijing’s strategy now hinges on self-reliance and parallel infrastructure. Billions are being funnelled into homegrown chip firms, elite university research programmes, and joint ventures with BRICS allies.

Key moves include:

- Expanding rare earth export restrictions — including elements critical to chipmaking like gallium and germanium.

- Launching state-led chip sovereignty initiatives, particularly in quantum computing and 3nm manufacturing.

- Tightening diplomatic and supply chain links with Russia, Iran, and Southeast Asia, reducing reliance on the West altogether.

Not unlike Russia’s pivot to internal AI development and narrative control amid its own sanction woes (https://newsfangled.co.uk/putins-clone-wars), China’s approach is designed to render China chip sanctions obsolete. If it can make its own chips, produce its own lithography machines, and bypass U.S.-controlled platforms, Washington’s economic leverage crumbles.

The Clash of Tech Futures

This chip war isn’t just about smartphones or military satellites. It’s about who controls the infrastructure of tomorrow: defence systems, autonomous vehicles, biotech platforms, digital currencies, and AI governance. Silicon is the new oil — and both superpowers want to own the wellhead.

The AI battlefield extends beyond statecraft. As highlighted in our recent piece on artificial intelligence in healthcare (https://newsfangled.co.uk/chatbots-in-charge-ai-therapists), control over chips also means controlling the pace and direction of AI across every sector.

As Foo puts it, this is a “clash of systems”, not a dispute over tariffs. One side champions free markets (with caveats); the other, state-driven acceleration. And while the U.S. still holds the high ground in innovation, China’s ability to scale and subsidise may shift the advantage over time. Many believe China chip sanctions are accelerating that transition.

What Comes Next?

With China closing its ranks and Trump digging in, analysts warn of further fragmentation in the global tech supply chain. Expect:

- More export controls on chipmaking tools and IP.

- New retaliatory tariffs on Western imports to China.

- National champions like SMIC (China) and Nvidia (U.S.) becoming even more central to policy debates.

As broader Western strategies face pressure across multiple fronts (https://newsfangled.co.uk/russia-question-west-fight), China chip sanctions are becoming a key pillar of 21st-century geopolitics.

For consumers and businesses, the fallout may be just beginning: higher gadget prices, slower product launches, and a tech ecosystem that increasingly reflects geopolitical fault lines.

One thing’s for sure — the future of global innovation no longer depends just on engineering talent. It now hinges on strategy, sovereignty, and silicon supremacy.. It now hinges on strategy, sovereignty, and silicon supremacy.

We want to hear your what you have to say