By Newsfangled Economics Desk

12 June 2025 | Cost of Living, Energy Policy, Corporate Influence, UK Economy

In this article

Once Public, Now Priceless

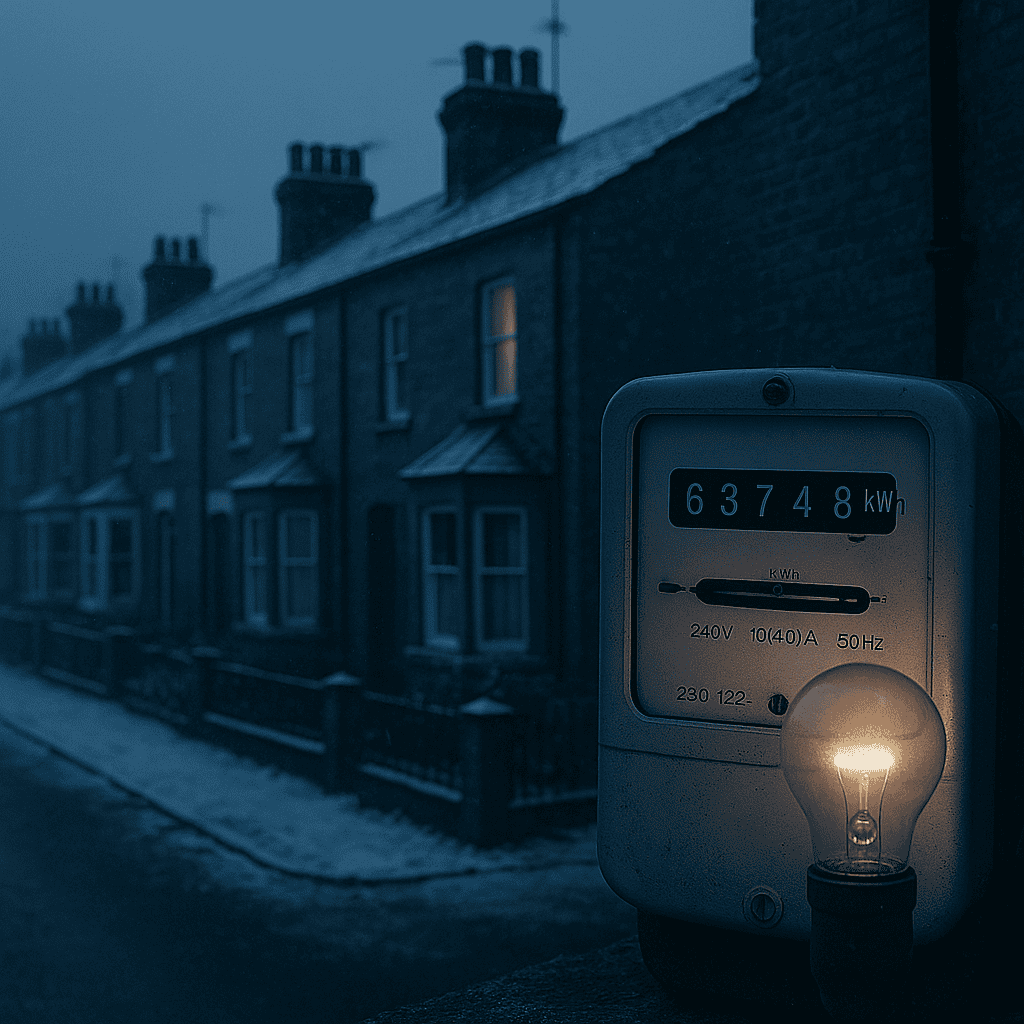

There was a time when Britain’s energy belonged to Britain. Power stations hummed under state control, gas flowed from publicly owned pipelines, and energy prices were affordable.

Then came the 1980s. With a flick of a pen and a flourish of ideology, the great sell-off began. Under the Thatcher government, Britain embraced privatisation with evangelical zeal. British Gas, British Electricity, the CEGB — all sold off, rebranded, and floated on stock markets in a haze of buzzwords: “efficiency,” “competition,” “modernisation.”

Four decades later, what exactly did we buy into?

Paying the Price: Privatisation and Energy Prices

Ask any British household — especially those still rationing heating in June — and they’ll tell you: we bought higher bills, foreign ownership, and a market that feels more like a rigged casino than a choice-driven utopia.

According to Ofgem data, average UK household energy bills nearly doubled between 2020 and 2023 — a rise of over 90 percent. Meanwhile, energy giants like Centrica (owner of British Gas) posted record profits exceeding £3 billion. BP and Shell declared windfall earnings that raised more eyebrows than a Downing Street party.

Where did those profits go?

Not to insulating homes. Not to upgrading infrastructure. And certainly not to reducing energy prices.

Heat or Eat: The New British Dilemma

Food banks now report people declining potatoes because they can’t afford to boil them. Pensioners skip meals to save for winter fuel. Children do homework in coats.

And while millions tighten their belts, some are still “helping the economy” one shopping spree at a time — as we explored here.

All while we’re told the “free market” will sort it out.

Who Owns Your Power Now?

Spoiler: it’s not Britain.

- EDF, the French state-owned energy giant, owns a major share of UK energy generation.

- Octopus Energy is heavily backed by global venture capital.

- Parts of the National Grid are owned by Australia’s Macquarie Group, nicknamed “The Vampire Kangaroo” for its aggressive investment tactics.

Privatisation promised competition. What we got was consolidation — and foreign control.

But Why Is It Still Legal?

If water companies are dumping sewage, and energy firms are charging the earth, why isn’t anyone stopping it?

Because power — real power — lies with money.

The energy sector is one of Westminster’s most politically active players. Former MPs sit on corporate boards. Private energy firms bankroll think tanks. Legislation moves slowly. Profits move quickly.

Corporate lobbying casts long shadows over public interest — and there’s little appetite in Parliament for systemic change.

The Case Against Privatisation and Energy Prices: Why Public Ownership Matters

Polls show that a majority of Britons support renationalising energy.

The argument? If the government underwrites energy production, sets price caps, and bails out failing firms — then surely the public should benefit from the profits.

State ownership doesn’t have to mean inefficiency. Countries like Norway and France show how public utilities can reinvest, stabilise energy prices, and lead the way in clean energy transitions.

The Bottom Line

Privatisation and energy prices aren’t abstract concepts — they’re why families dread the next bill.

They’re why profits are up and trust is down. Why infrastructure crumbles while shareholders cash in.

Britain lit the fuse on its own power supply — and the explosion landed on our doormats.ritain lit the fuse on its own power supply — and the explosion landed on our doormats.

As privatisation and energy prices continue to dominate headlines and household budgets, the question is no longer whether change is needed — but when.

Reader Comments

Do you think renationalising energy is the answer?

Is it time to unplug from privatised profit and reconnect with public control?

We want to hear your what you have to say